Quashing Specific Performance and Piercing the Veil: Southcott Estates Inc v Toronto Catholic District School Board

Southcott Estates Inc v Toronto Catholic District School Board, [2012] 2 SCR 675, is about an agreement to buy surplus school land for use as a housing development. The school board did not complete the transaction, and it was undeniably in breach of contract. Interestingly, at the end of a long legal process, the plaintiff Southcott received neither specific performance nor in the alternative, monetary damages. This is contrary to what one would expect, and it is worth looking at because transactions of this type are fairly common.

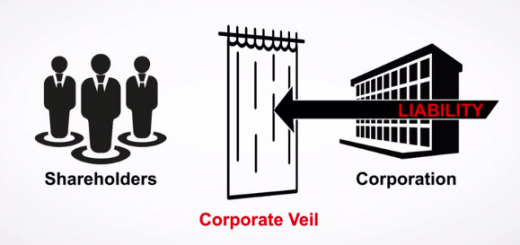

There are two significant statements of principle coming from the Supreme Court (“SCC”) in this case. The first one relates to specific performance, and the second one amounts to a new ground for piercing the corporate veil for single purpose subsidiaries. Justice Karakatsanis delivered the opinion of a 6-to-1 majority.

Specific Performance is Rarely Available for Commercial Real Estate

The principle of specific performance is applicable when the subject matter of the contract is something unique, such as a work of art or a piece of land with special characteristics. In these cases, monetary damages would not suffice to compensate the disappointed buyer. It is an equitable remedy that may be available to a purchaser when the seller fails to complete the transaction, and being equitable, it is always at the discretion of the court to decide whether it should be granted or not.

The guiding principle that should govern specific performance in a modern economy was aptly stated by Adams J in his influential decision in Domowicz v Orsa Investments Ltd, 1993 CanLII 5472 (ON SC):

Damages will ordinarily be adequate in a market economy to enable the aggrieved promisee to obtain an acceptable substitute and will encourage economic activity and minimize economic waste; only where this remedy is inadequate will a court decree specific performance, as in the case of unique goods where damages are inadequate because there may be no available substitute transaction.

The SCC has decisively curtailed the availability of specific performance in the context of commercial land transactions. In Southcott, the Court reinforced the principle enunciated by Sopinka J in Semelhago v Paramadevan, [1996] 2 SCR 415, at para 22, that specific performance should, “…not be granted as a matter of course absent evidence that the property is unique.”

Unlike somebody who has his heart set on a particular house to live in, a developer is only interested in the land for the profit that it will yield. From this point of view, one piece of land is pretty much like another:

A plaintiff deprived of an investment property does not have a “fair, real, and substantial justification” or a “substantial and legitimate” interest in specific performance … unless he can show that money is not a complete remedy because the land has “a peculiar and special value” to him…. Southcott could not make such a claim. It was engaged in a commercial transaction for the purpose of making a profit. The property’s particular qualities were only of value due to their ability to further profitability. (para 41)

Being a Single-Purpose Corporation Did not Excuse Southcott from the Duty to Mitigate

Holding out for specific performance turned out to be a strategic mistake for Southcott, that resulted in it coming away empty-handed. Ordinarily, if specific performance is not granted, the victim of the breach can still seek damages to compensate it for its lost expectation of profit. However, before it can ask for damages, it must show that it could not have made just as much money by quickly making an alternative purchase when the first contract is breached. This is the principle of mitigation:

Losses that could reasonably have been avoided are, in effect, caused by the plaintiff’s inaction, rather than the defendant’s wrong. As a general rule, a plaintiff will not be able to recover for those losses which he could have avoided by taking reasonable steps. Where it is alleged that the plaintiff has failed to mitigate, the burden of proof is on the defendant, who needs to prove both that the plaintiff has failed to make reasonable efforts to mitigate and that mitigation was possible. (para 24)

Southcott thought it had a reasonable argument for failing to mitigate. It was a single purpose corporation with limited capital, set up by its parent company for the purpose of this specific transaction and no other. It argued that it had all its capital tied up in this transaction, and it did not have the resources to mitigate by seeking an alternative purchase.

The Court rejected this argument by effectively piercing the corporate veil, and viewing Southcott as what it was, a member of a large corporate group. Evidence had been shown at the trial that Southcott’s parent company was regularly buying similar pieces of land during the course of this lawsuit. It had the resources, and it could easily have bought one more piece of land to compensate for this failed acquisition. As noted by the Court,

Real estate developers frequently create single-purpose corporations for the sole purpose of purchasing and developing properties for profit. The corporation has limited liability and no assets other than those that arise from the particular real estate investment. (para 1)

The SCC appears to take a dim view of such artificial corporate structures:

Finding that losses cannot be reasonably avoided, simply because it is a single-purpose corporation within a larger group of companies, would give an unfair advantage to those conducting business through single-purpose corporations…. Those who choose the benefits of incorporation must bear the corresponding burdens. (paras 29-30)

At first sight, the last sentence may appear puzzling. Southcott was a corporation, and was asking to be viewed as a separate legal personality independent of its owner. That is one of the usual benefits of incorporation, and that is what the SCC refused to give it. What did the court mean by the “corresponding burdens”?

If one thinks of the deeper reason why these deals are done through special purpose corporations, the statement begins to make sense. Developers structure purchases this way so that, if a market correction reduces land values, the parent company can pull the plug on its subsidiary, and avoid liability for damages for not completing a purchase. If the purchaser had backed out, and the land had declined substantially in value, the seller would have been unable to recover any damages beyond the deposit. Therefore, it is arguably fair that Southcott failed to recover damages when the shoe was on the other foot. The Court of Appeal had awarded nominal damages of $1, and its decision was affirmed by the Supreme Court.

Join the conversation